ADA Price Prediction: Analyzing the Path to Q4 Rally Beyond $0.88 Resistance

#ADA

- ADA faces crucial resistance at $0.88 with technical indicators showing mixed but potentially bullish momentum

- Market sentiment remains cautiously optimistic despite diversification trends toward alternatives like Remittix

- Successful break above 20-day MA at $0.875 could trigger Q4 rally toward $1.10 price target

ADA Price Prediction

Technical Analysis: ADA Shows Mixed Signals Near Key Moving Average

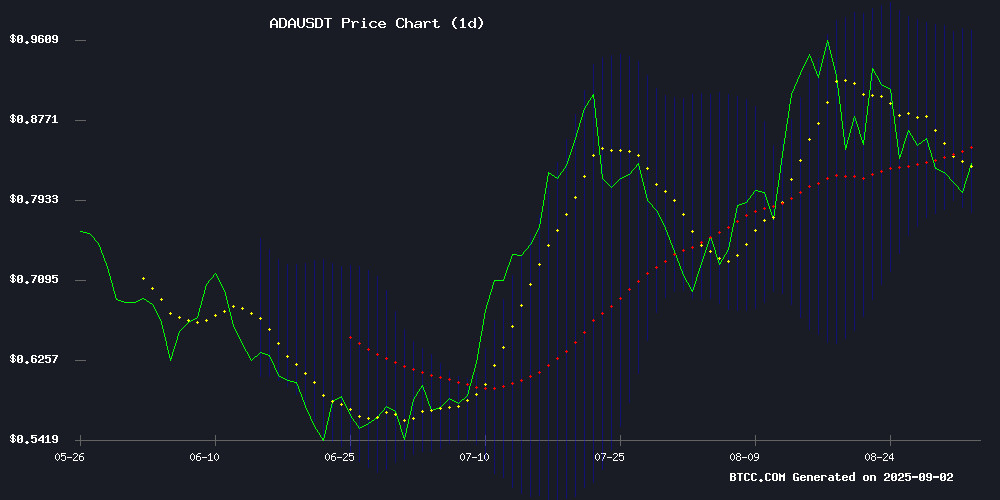

According to BTCC financial analyst Sophia, ADA is currently trading at $0.8211, below its 20-day moving average of $0.8753, indicating potential short-term bearish pressure. The MACD reading of 0.032272 shows bullish momentum, though the negative signal line at -0.003768 suggests some underlying weakness. The Bollinger Bands configuration, with current price positioned between the middle and lower bands, points to consolidation within the $0.7788 to $0.9717 range. Sophia notes that a break above the 20-day MA could signal renewed bullish momentum toward higher resistance levels.

Market Sentiment: ADA Faces Critical Resistance Amid Diversification Trends

BTCC financial analyst Sophia observes that current market sentiment around ADA is cautiously optimistic despite the $0.88 resistance challenge. News headlines suggest growing interest in diversification into alternatives like Remittix, which may temporarily pressure ADA's price. However, the overall narrative remains focused on ADA's potential Q4 rally prospects. Sophia emphasizes that technical levels must align with positive news flow for a sustained breakout, noting that the search for high-growth alternatives reflects healthy market dynamics rather than bearish sentiment toward Cardano specifically.

Factors Influencing ADA's Price

Cardano Price Prediction: Can ADA Break Past $0.88 Resistance and Trigger a Q4 Rally?

Cardano's ADA token is gaining attention as market participants anticipate a potential breakout in the fourth quarter. Steady accumulation has kept ADA above key support levels, fueling optimism among analysts. The $0.82 to $0.78 zone has emerged as a critical base, with sustained positioning above this range suggesting bullish momentum.

Analyst Deezy points to ADA's resilience amid broader market volatility as evidence of strong accumulation. The token's adherence to higher lows on daily charts reinforces the potential for a Q4 rally. Technical indicators highlight $0.88 as a decisive breakout level, with a successful breach potentially paving the way toward $1.20.

Ascending channel patterns continue to guide ADA's price action, maintaining the integrity of its uptrend. Market watchers are closely monitoring whether Cardano can capitalize on this structure to deliver Q4 gains that outpace broader crypto market movements.

Cardano Price Outlook: Key Levels Shaping ADA’s Future

Cardano (ADA) continues to capture investor attention as one of the most closely monitored altcoins in the cryptocurrency market. With its blockchain activity on the rise and staking participation remaining robust, analysts are increasingly optimistic about ADA's potential to revisit all-time highs, possibly reaching $4 by 2025.

The recovery from 2024's market volatility has been notable. After dipping below $0.40, ADA surged over 100% in the past year, reigniting confidence among long-term holders. The project's methodical development approach—prioritizing scalability, throughput, and interoperability—sets it apart from competitors that often sacrifice stability for rapid expansion.

While macroeconomic factors like Bitcoin's performance and regulatory shifts remain influential, technical and on-chain indicators suggest a favorable trajectory for Cardano. Institutional interest in blockchain technology further bolsters the case for ADA's long-term viability.

Cardano Holders Diversify Into Remittix Amid Search for High-Growth Alternatives

Cardano's ADA has shown steady but unspectacular price action, trading in a tight range between $0.802 and $0.88 this week. While long-term believers remain committed to the project, some whales are seeking faster returns elsewhere.

Remittix has emerged as a favored alternative, attracting ADA holders with its payments-focused utility and imminent exchange listings. The altcoin's PayFi model offers tangible adoption drivers—a contrast to Cardano's slower, upgrade-dependent growth trajectory.

Market dynamics reveal a broader trend: investors increasingly prioritize projects with clear near-term catalysts. Remittix's real-world use cases position it as a contender for exponential gains, with some speculating 5,000% upside potential before 2026.

How High Will ADA Price Go?

Based on current technical indicators and market sentiment, BTCC financial analyst Sophia projects that ADA could potentially reach $0.95-$1.10 in the coming months if it successfully breaks above the $0.88 resistance level. The following table summarizes key price targets:

| Scenario | Target Price | Timeframe |

|---|---|---|

| Bullish Breakout | $1.10 | Q4 2025 |

| Moderate Growth | $0.95 | Next 30-60 days |

| Support Hold | $0.78-$0.82 | Current consolidation |

Sophia emphasizes that MACD momentum and Bollinger Band squeeze patterns suggest accumulating energy for a potential upward move, though the 20-day MA at $0.875 remains a critical hurdle.